Peoria County Property Appraiser

Peoria County Board Approves Budget for 2026 • Peoria County, IL

The Peoria County Board on Thursday approved Peoria County’s $174.2 million budget for fiscal year 2026, which is January 1-December 31, 2026. Highlights include: $31.7 million for capital projects, including $3.5 million in pre-construction services to prepare for upgrades to the Peoria County Jail and numerous road and bridge projects Stewardship of taxpayer dollars through strategic drawdowns of reserve savings, with no increase to the prop...

https://www.peoriacounty.gov/CivicAlerts.aspx?AID=1229

Notice of Proposed Property Tax Increase for Peoria County

A public hearing to approve a proposed property tax levy increase for Peoria County for 2026 will be held on November 5, 2025 at 3:30 p.m. at the Peoria ...

https://www.peoriacounty.gov/CivicAlerts.aspx?AID=1215Tax Relief / Exemptions Peoria County, IL

- Home - Departments - Real Estate Tax Cycle Services - Treasurer - Property Taxes - Tax Relief - Tax Relief / Exemptions Tax Relief / Exemptions Known as the owner-occupied exemption, this exemption lowers the equalized assessed value of your property by $6,000.

https://www.peoriacounty.gov/399/Tax-Relief-Exemptions

Peoria County committee adopts 2026 legislative agenda ...

Peoria County committee adopts 2026 legislative agenda, highlights delinquent tax-sale reform and infrastructure requests. January 07, 2026 | ...

https://citizenportal.ai/articles/7258881/Peoria-County/Illinois/Peoria-County-committee-adopts-2026-legislative-agenda-highlights-delinquent-tax-sale-reform-and-infrastructure-requestsFee increases approved in Peoria County 2026 budget

Fees for most departments will take full effect in 2026, but the County Clerk's Office hikes will see a two-year ramp.

https://www.pjstar.com/story/news/local/2025/11/13/fee-increases-approved-in-peoria-county-2026-budget/87261702007/Peoria County funds jail upgrades with level tax rate in $174 million budget WCBU Peoria

Peoria County is keeping its property tax rate the same for 2026, but will still bring an about $2 million more through increased taxable land values. The county’s $174.2 million budget for 2026, which the county board adopted Thursday, devotes $31.7 million in capital projects, including $3.5 million in pre-construction services for Peoria County Jail upgrades.

https://www.wcbu.org/local-news/2025-11-14/peoria-county-funds-jail-upgrades-with-level-tax-rate-in-174-million-budget

Time is running out to renew... - Peoria County Government

Time is running out to renew property tax exemptions for low-income seniors, veterans with disabilities, and persons with disabilities. Learn more about how the exemptions work, and how to renew or apply, on the latest episode of the Peoria County Distilled podcast.

https://www.facebook.com/peoriacountygov/posts/time-is-running-out-to-renew-property-tax-exemptions-for-low-income-seniors-vete/1343028387865930/Proposed property tax levy increase could cost Peoria homeowners more

PEORIA (25News Now) - Although Peoria’s property tax rate is expected to stay the same for the year, city leaders are once again considering raising the total property tax levy. During a special city council meeting on Tuesday night, council members heard the proposed tax levy, which would draw in tax revenue based on an around 6.5% increase in home values.

https://www.25newsnow.com/2025/10/01/proposed-property-tax-levy-increase-could-cost-peoria-homeowners-more/

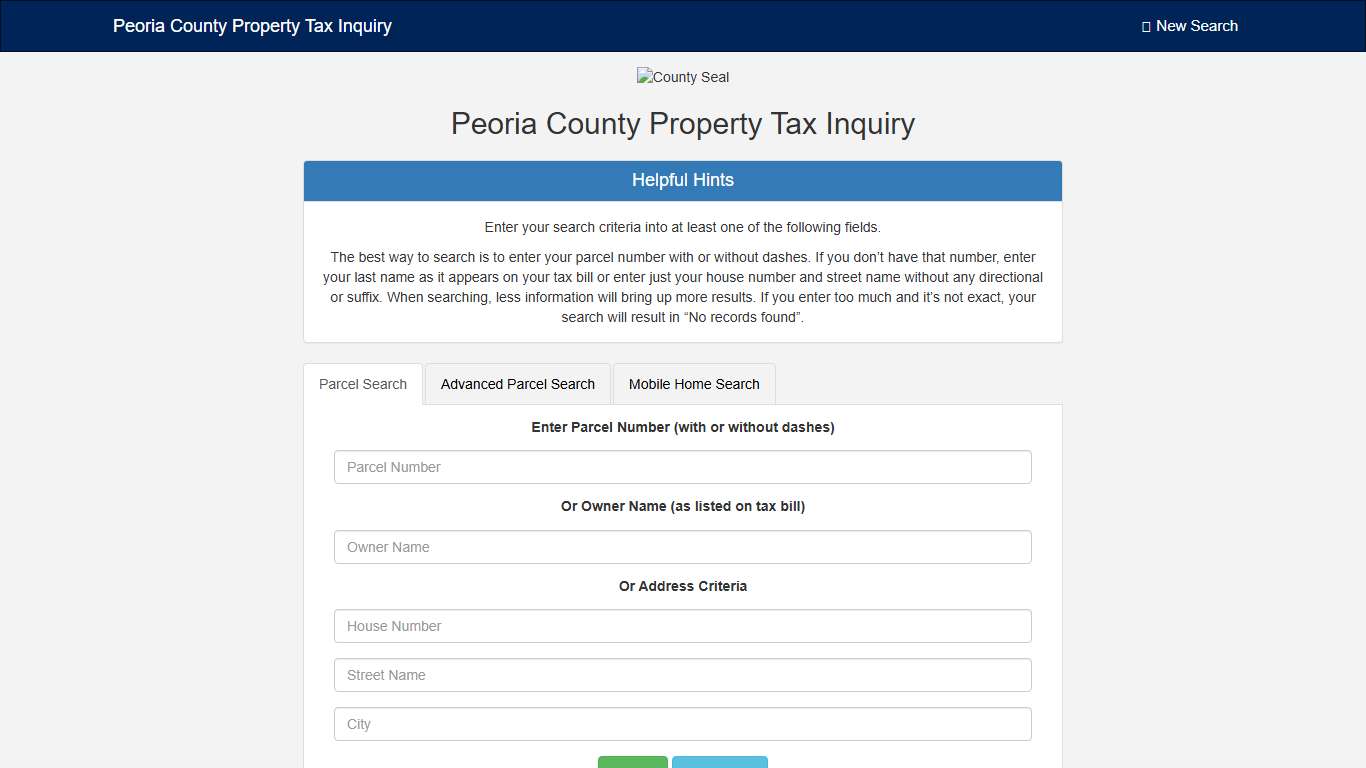

Peoria County Property Tax Inquiry

Peoria County Property Tax Inquiry Helpful Hints Enter your search criteria into at least one of the following fields. The best way to search is to enter your parcel number with or without dashes. If you don’t have that number, enter your last name as it appears on your tax bill or enter just your house number and street name without any directional or suffix.

https://propertytax.peoriacounty.gov/

Here's everything to know about the Peoria County Fiscal Year 2026 budget in less than 30 minutes. Listen to the latest Peoria County Distilled podcast on Apple, Spotify, iHeartRadio or Audible today! 🔊 https://www.spreaker.com/episode/breaking-down-peoria-s-county-s-fiscal-year-2026-budget--68948758 Listen to the latest Peoria County Distilled podcast on Apple, Spotify, iHeartRadio or Audible today! 🔊 https://www.spreaker.com/episode/breaking...

https://www.instagram.com/p/DSEJ_LHjeN2/

Assessor’s Office – City of Peoria Township

Assessor’s Office Monday- Friday 8:00-4:30 (309)324-7459 The Peoria Township is the largest township in Peoria County with over 43,000 parcels and a market value over $5.3 Billion. The Assessor is responsible for establishing the values on all parcels within the Peoria Township with the highest standards of professionalism.

https://peoriatownshipil.com/services/town-collector/

Peoria County, IL Property Tax Calculator 2025-2026

Calculate Your Peoria County Property Taxes Peoria County Tax Information How are Property Taxes Calculated in Peoria County? Property taxes in Peoria County, Illinois are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 2.32% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/illinois/peoria-county

Peoria County approves $174 million budget - Chronicle Media

PEORIA — The Peoria County Board has approved a $174.2 million budget for fiscal year 2026, which includes $31.7 million for capital projects, including $3.5 million in pre-construction services to prepare for upgrades to the County Jail and numerous road and bridge projects.

https://chronicleillinois.com/news/peoria-county-approves-174-million-budget-2/

Your property tax bill in Peoria could go up. Here's why:

Why some Peoria homeowners could pay more in property taxes under 2026 proposal - The city of Peoria is proposing an increase in the total amount of property taxes levied. - Property tax rates will not increase in Peoria. PEORIA — The city of Peoria is once again proposing to raise its total property tax levy, meaning some homeowners could pay more on their property tax bills in 2026.

https://www.pjstar.com/story/news/local/2025/10/01/your-property-tax-bill-in-peoria-could-go-up-heres-why/86446962007/